AML Risk Management for the Modern Financial World

Transform complex compliance requirements into clear, actionable insights with our global monitoring platform.

Scroll to explore

Laundered Globally Each Year

AML Penalties in 2024

Suspicious Transactions Daily

Countries with AML Regulations

iTrackAML: Secure. Simple. Compliant.

Compliance is complex. iTrack makes it simple—helping you assess client risk, stay ahead of regulations, and prove compliance with confidence.

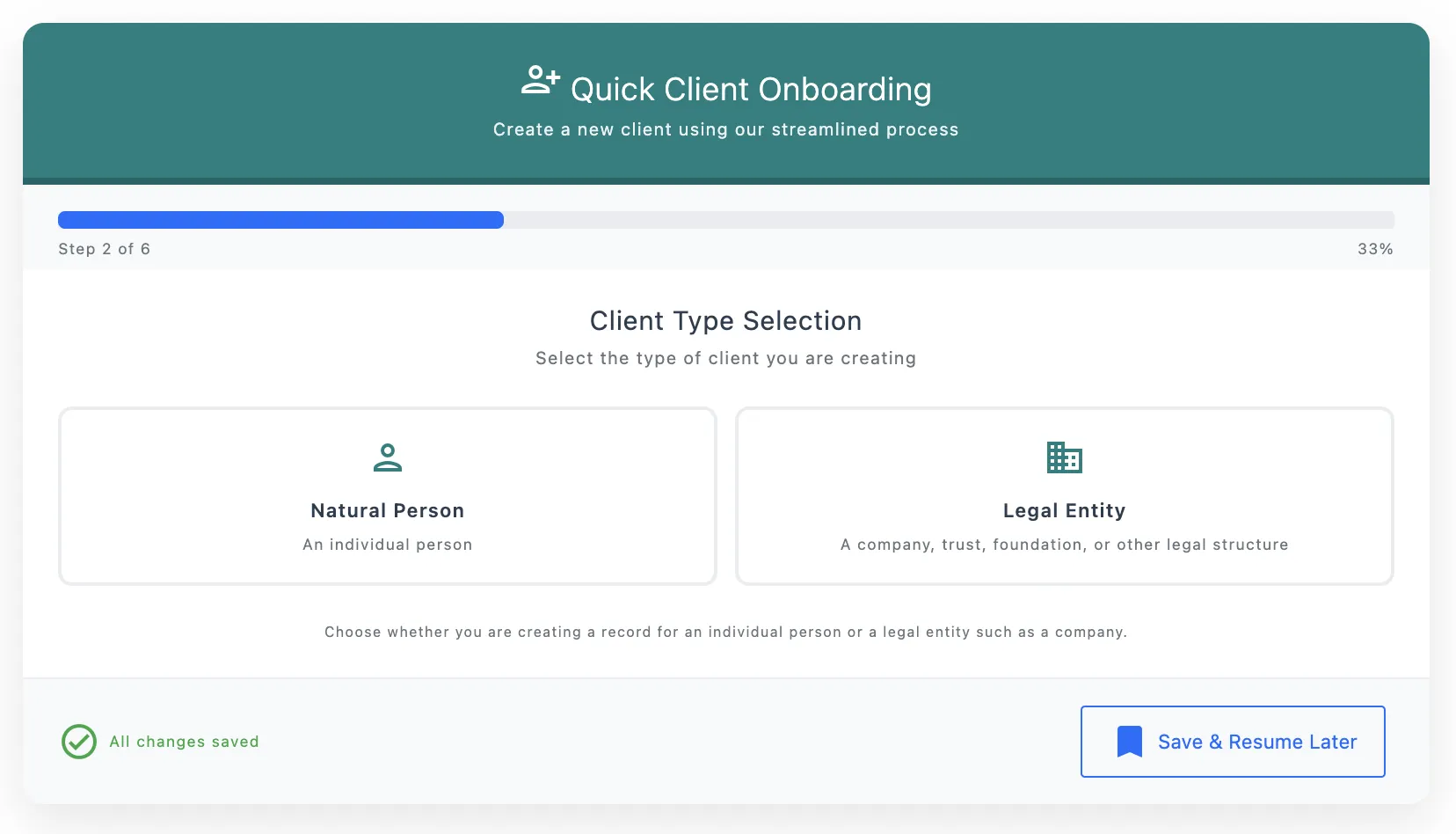

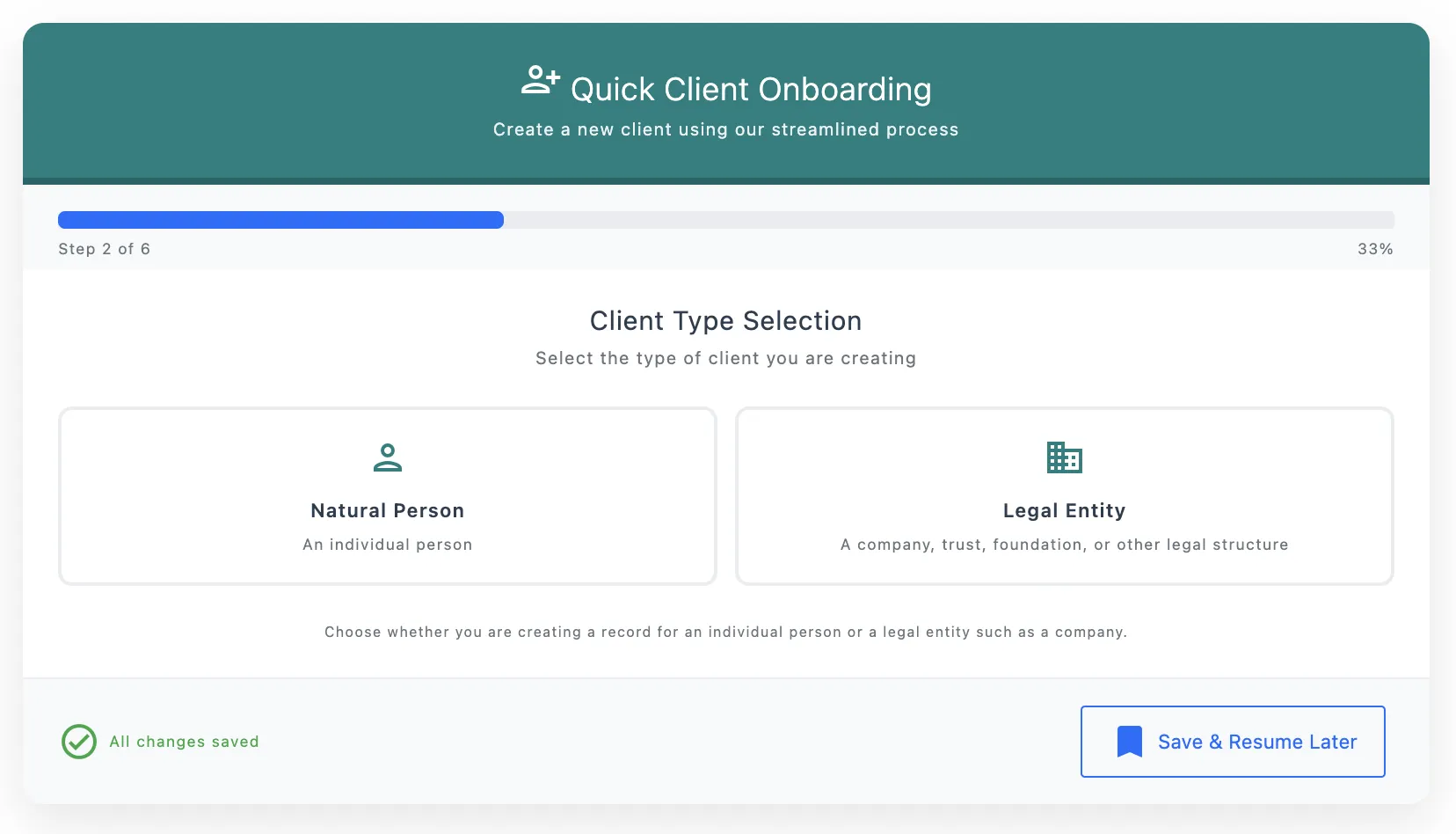

Client Onboarding

Onboard individuals and complex entities fast—manually or via secure client invites. Save sessions, set expiries, and capture controllers/shareholders without the chaos.

- Fast onboarding for individuals and complex entities

- Manual entry or secure client invite options

- Save sessions and set automatic expiry dates

- Capture controllers and shareholders seamlessly

Powerful Features for Complete AML Compliance

iTrackAML offers a comprehensive suite of tools designed to simplify compliance while ensuring thorough risk assessment and monitoring.

Seamless Client Onboarding

Onboard individuals or complex legal entities with ease—manually, or invite clients to self-onboard securely.

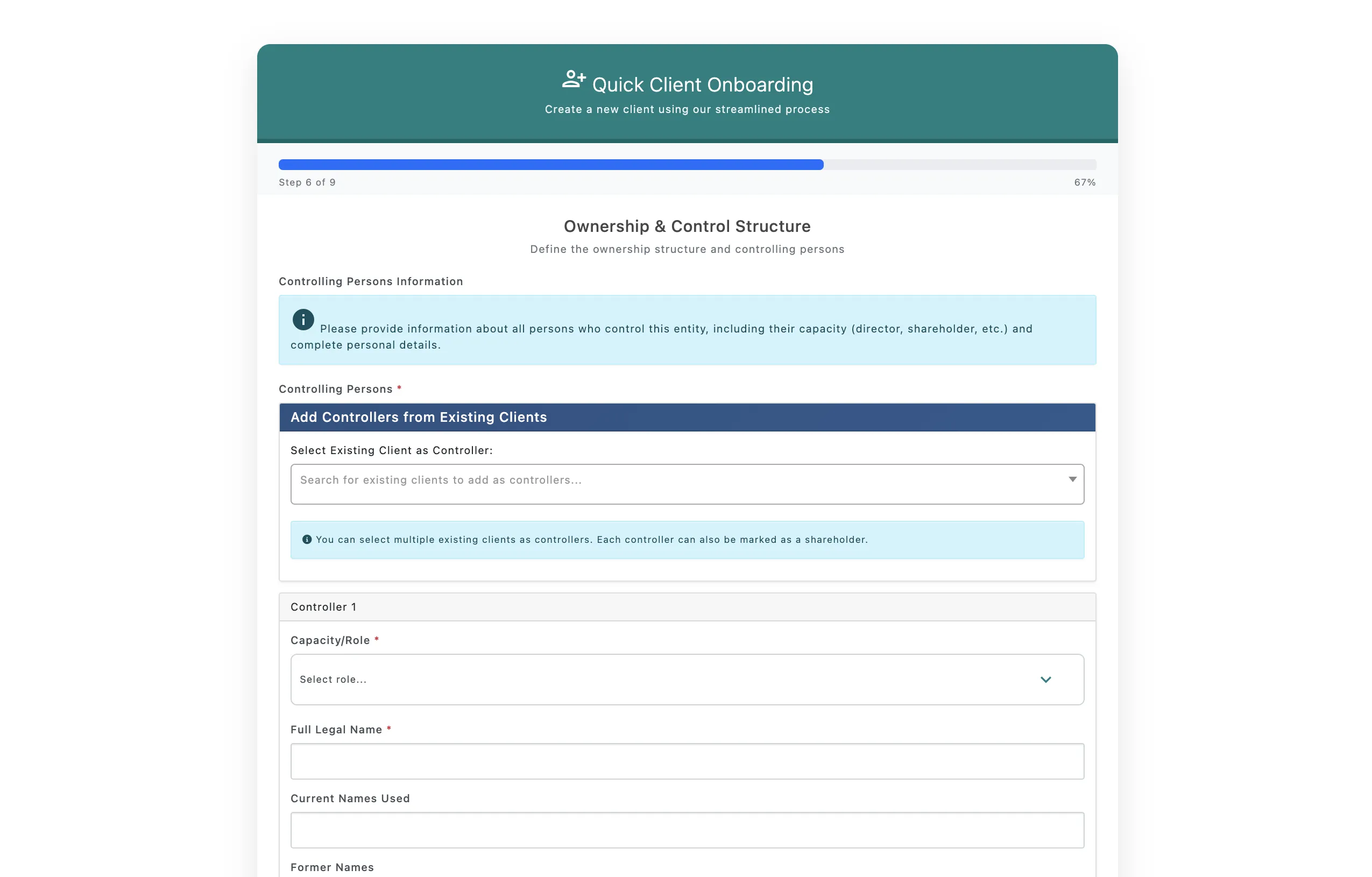

Flexible Entity Structures

Capture ownership hierarchies, controllers, and shareholders with complete transparency.

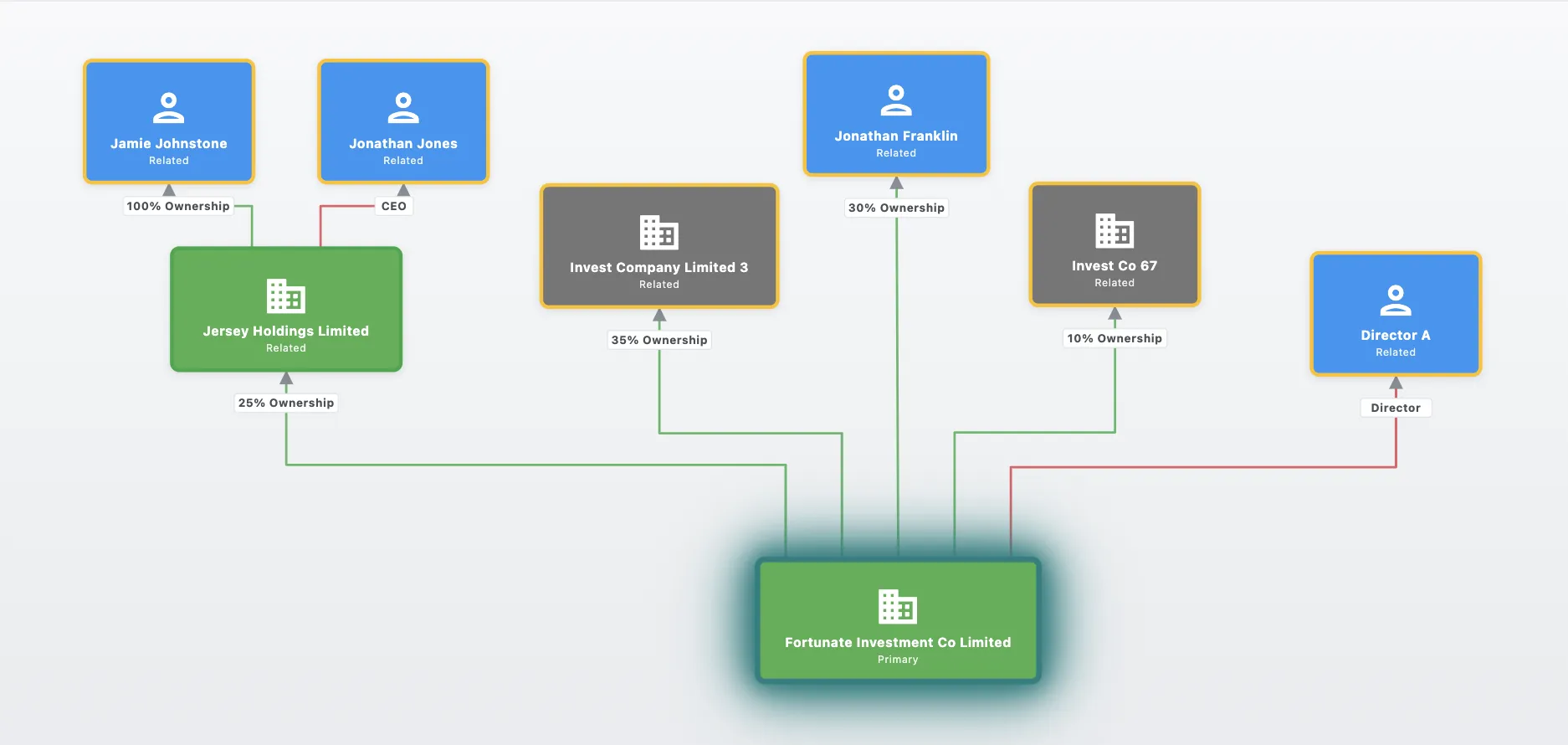

Visual Client Networks & UBOs

Bring clarity to complexity with interactive organisational diagrams and automatic UBO calculations.

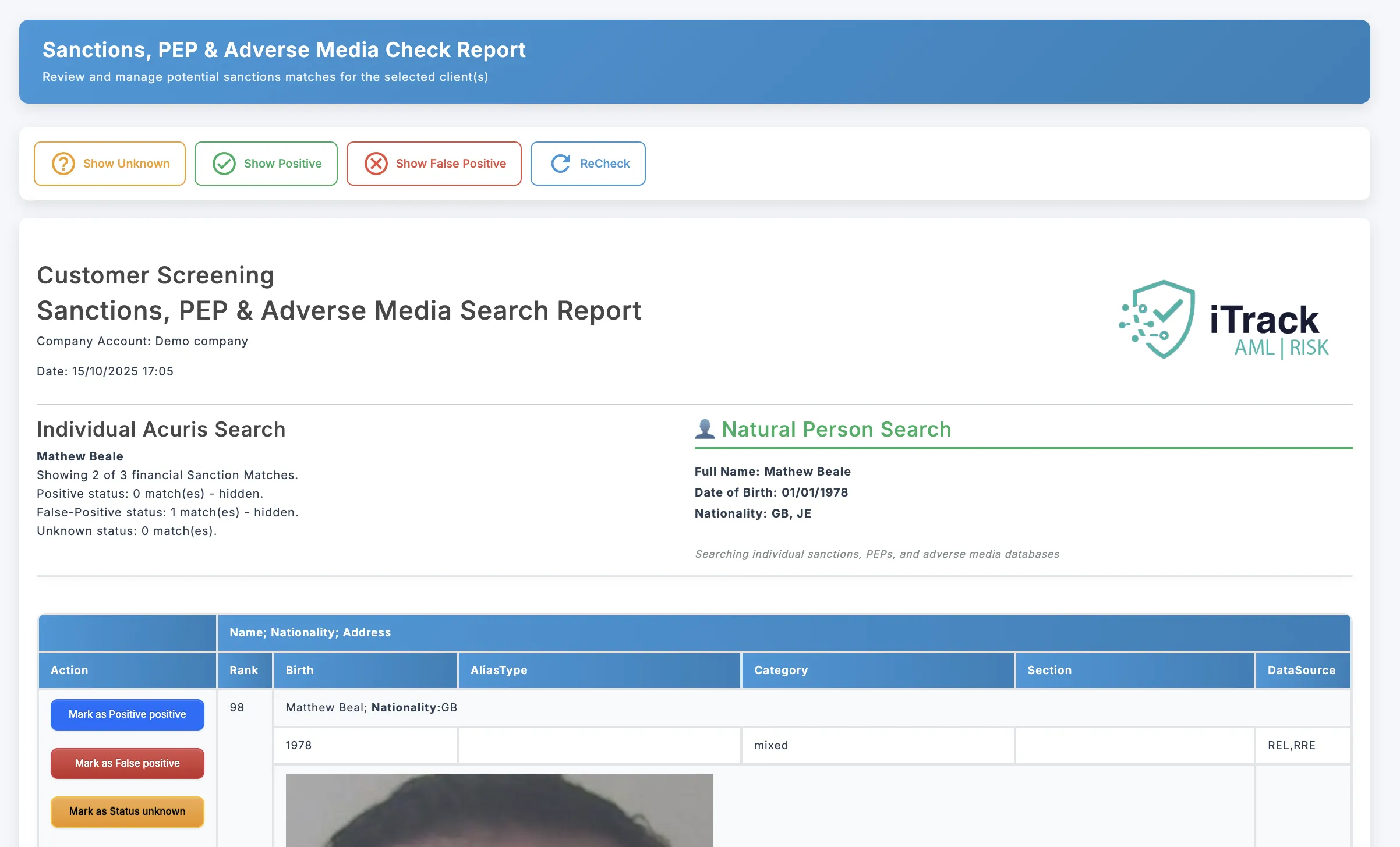

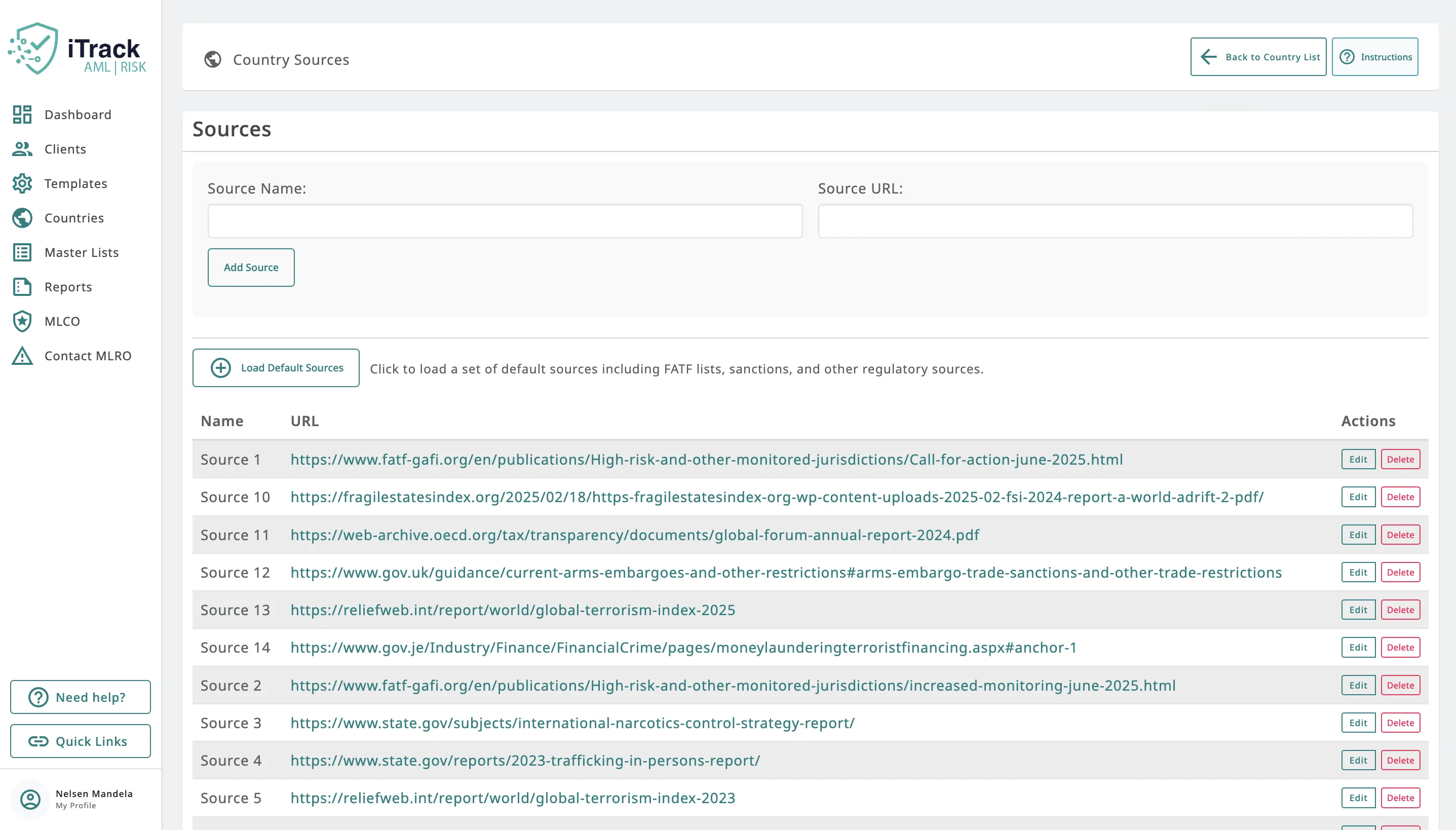

Global Sanctions & PEP Screening

Screen sanctions, PEPs, and adverse media instantly—all in one trusted platform.

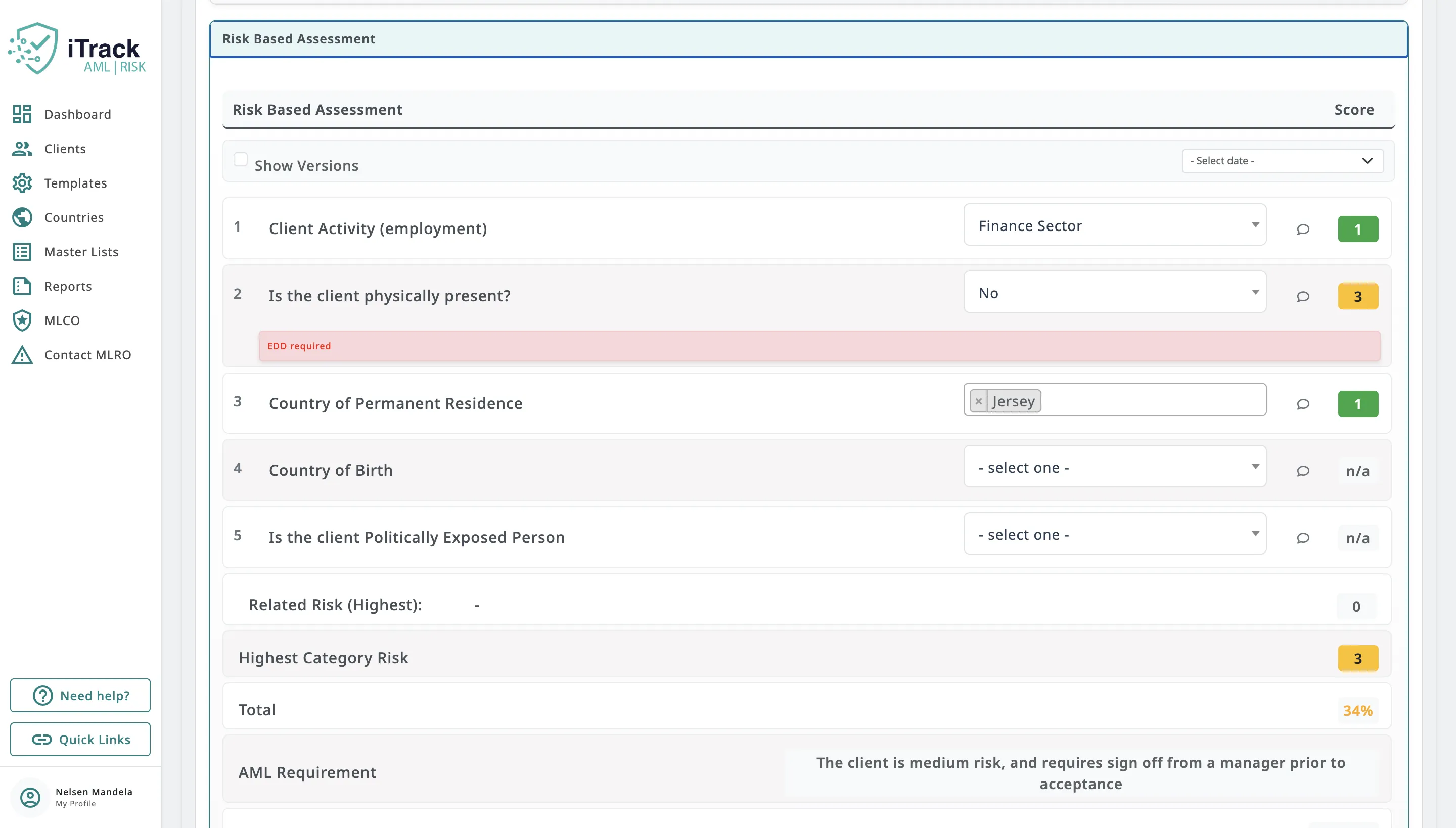

Dynamic Risk Profiling

Automated, data-driven scoring gives you a full picture of client, product, and geographic risk.

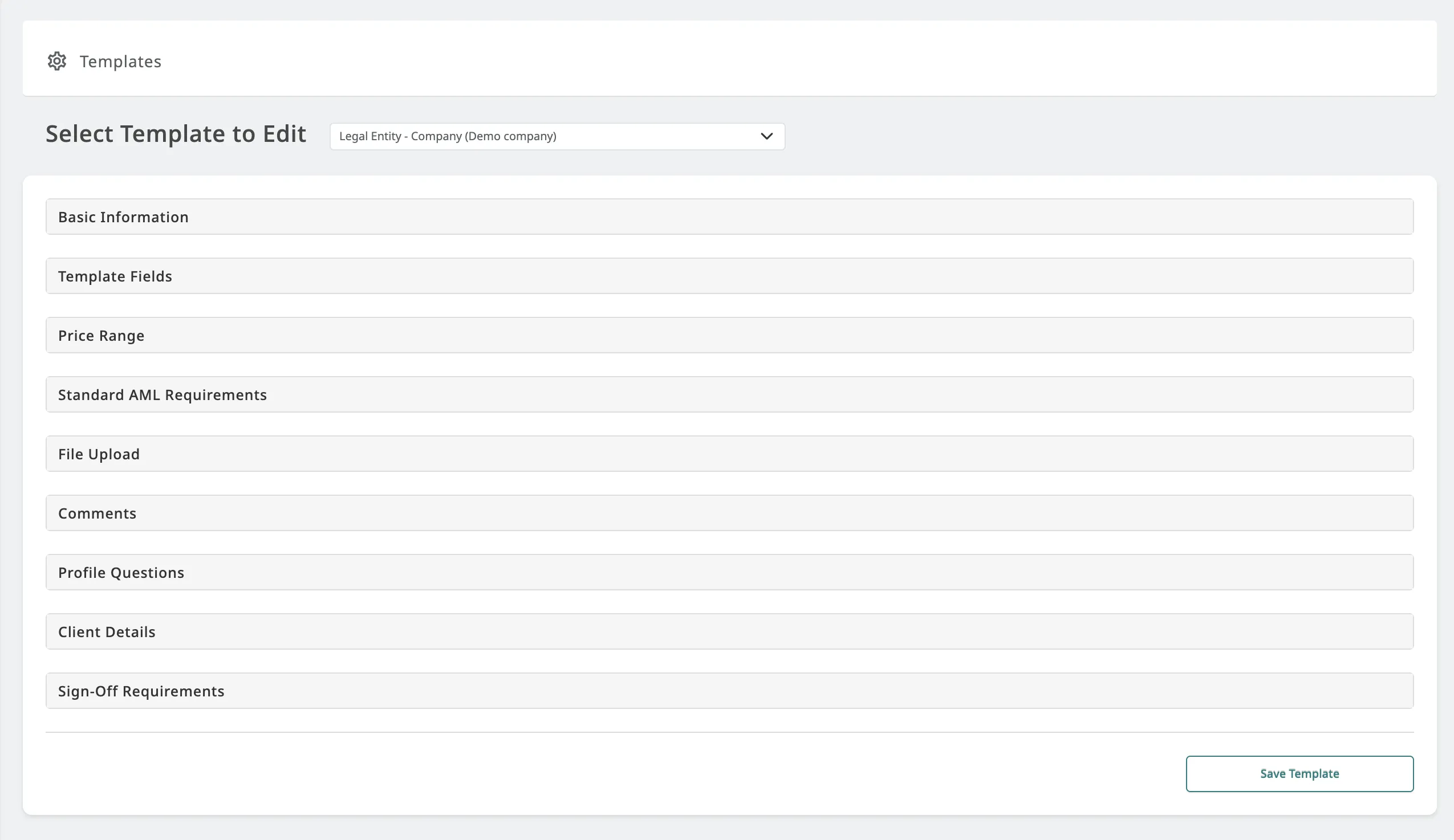

Customisable Assessments & Templates

Adapt assessments to your compliance framework, aligned with international standards.

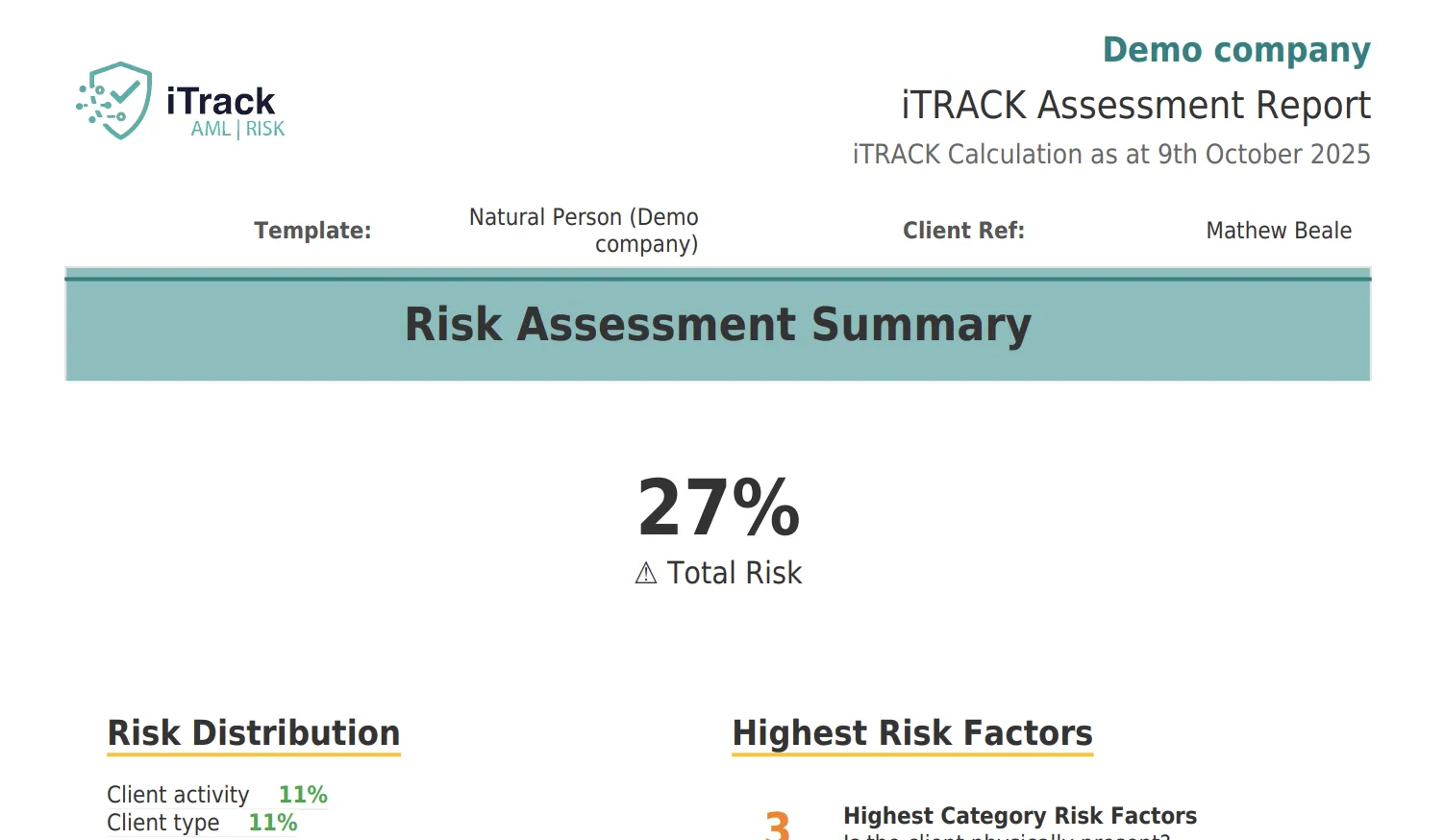

Presentation-Ready Reporting

Generate and share polished reports and PDFs that regulators and stakeholders trust.

Global AML Standards Compliance

Stay aligned with FATF, Wolfsberg, and local regulators—built into iTrack's DNA.

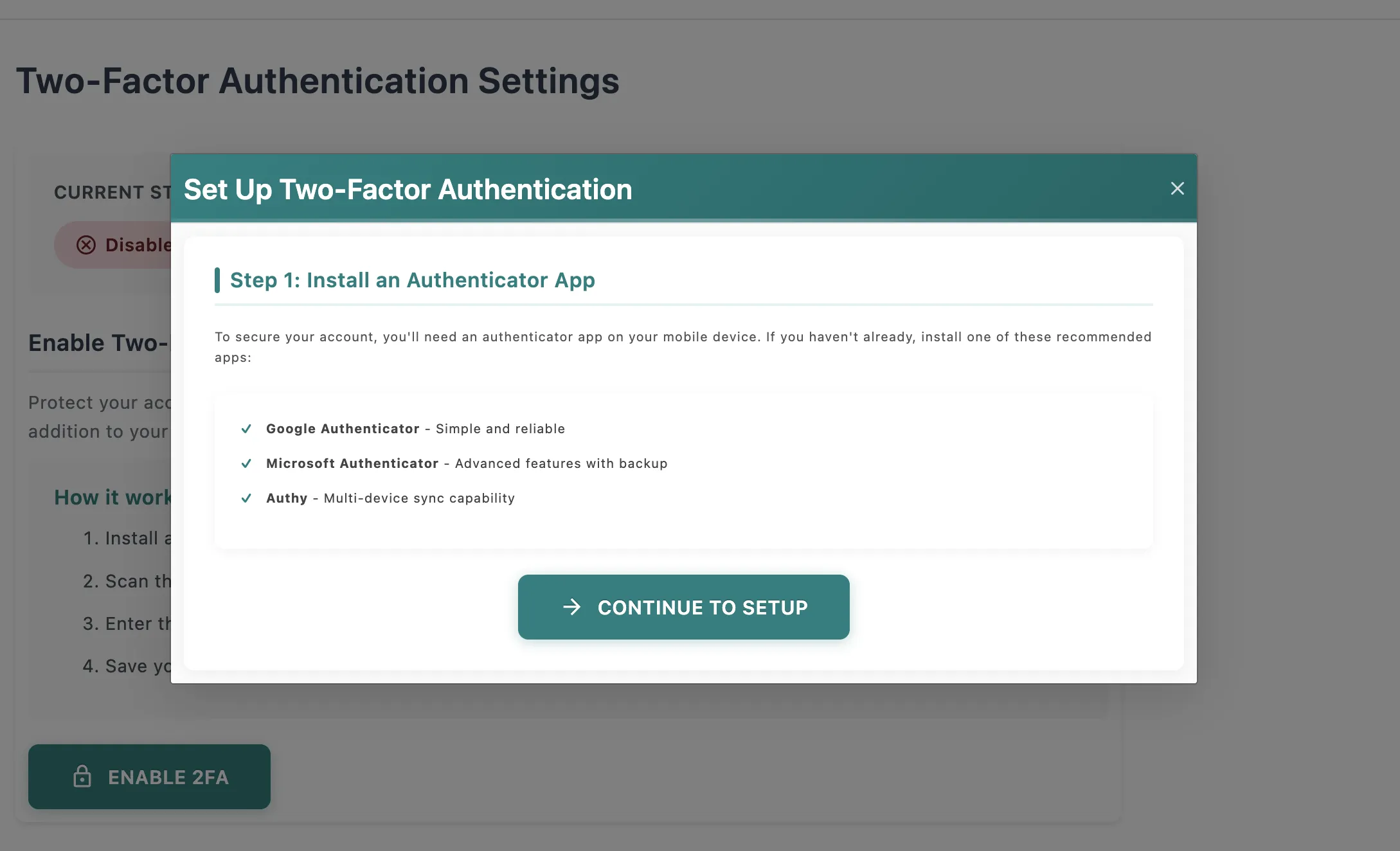

Enterprise-Grade Security

Safeguard data with robust controls, including two-factor authentication.

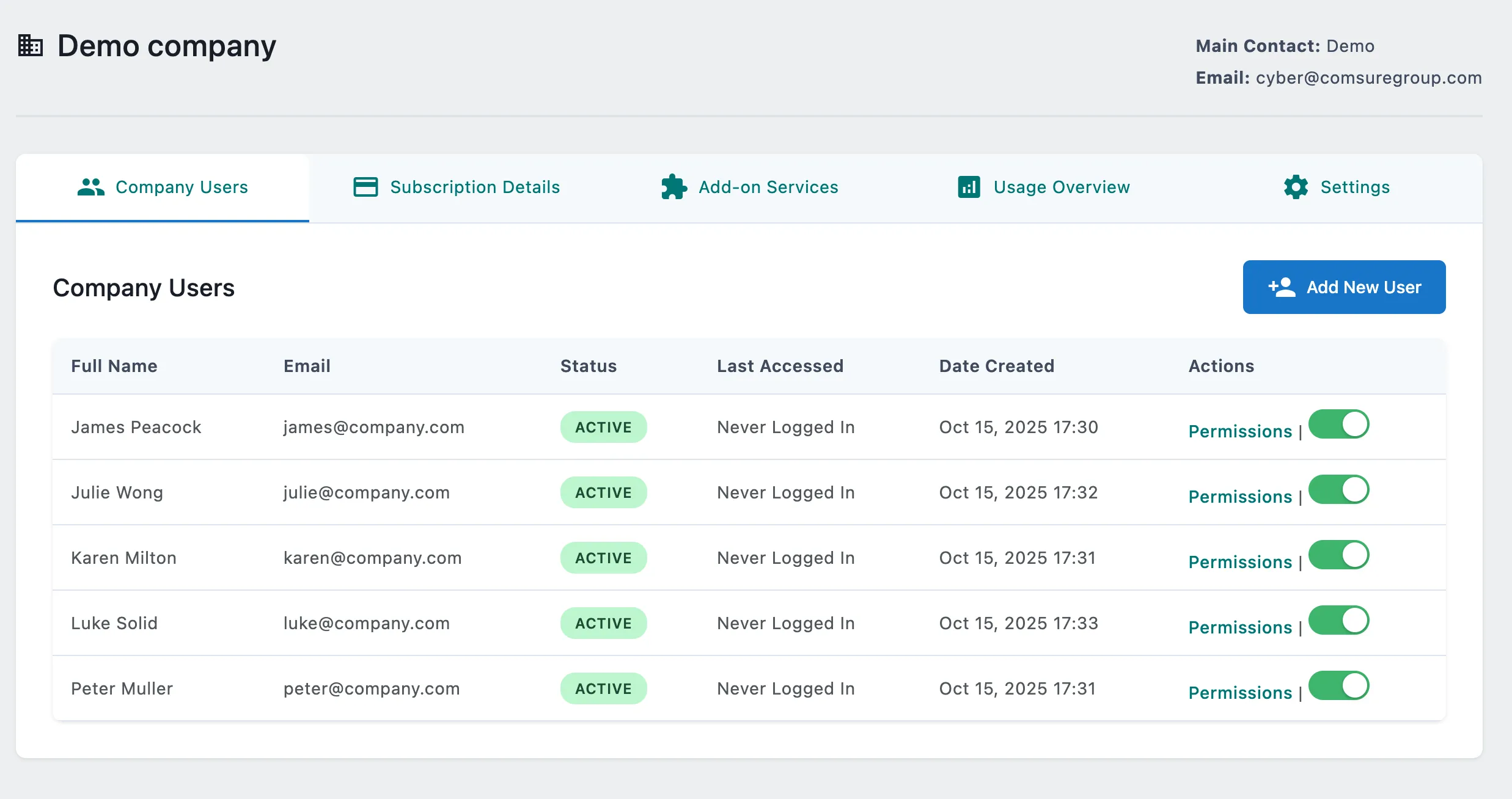

Subscription & User Management

Easily track usage, payments, add-ons, and user permissions—all in one place.

Seamless Client Onboarding

Onboard individuals or complex legal entities with ease—manually, or invite clients to self-onboard securely.

Flexible Entity Structures

Capture ownership hierarchies, controllers, and shareholders with complete transparency.

Visual Client Networks & UBOs

Bring clarity to complexity with interactive organisational diagrams and automatic UBO calculations.

Global Sanctions & PEP Screening

Screen sanctions, PEPs, and adverse media instantly—all in one trusted platform.

Dynamic Risk Profiling

Automated, data-driven scoring gives you a full picture of client, product, and geographic risk.

Customisable Assessments & Templates

Adapt assessments to your compliance framework, aligned with international standards.

Presentation-Ready Reporting

Generate and share polished reports and PDFs that regulators and stakeholders trust.

Global AML Standards Compliance

Stay aligned with FATF, Wolfsberg, and local regulators—built into iTrack's DNA.

Enterprise-Grade Security

Safeguard data with robust controls, including two-factor authentication.

Subscription & User Management

Easily track usage, payments, add-ons, and user permissions—all in one place.

Aligned with Global Compliance Standards

iTrackAML is built to meet and exceed the most stringent international regulatory requirements, providing you with confidence and peace of mind.

FATF Recommendations

Aligned with the Financial Action Task Force standards for combating money laundering.

EU AML Directives

Compatible with all requirements of the EU's anti-money laundering framework.

Wolfsberg Principles

Follows the Wolfsberg Group's principles for effective risk management.

JFSC Requirements

Meets Jersey Financial Services Commission regulatory expectations.

GFSC Standards

Complies with Guernsey Financial Services Commission guidelines.

Need to Meet Specific Regulatory Requirements?

Discover how iTrackAML keeps you compliant across multiple jurisdictions and regulatory frameworks.

Built for Regulated Environments

Our defence-in-depth security model applies layered protections to safeguard the confidentiality, integrity, and availability of your data.

Enterprise Infrastructure

Hardened cloud infrastructure with automated security updates and continuous monitoring.

Data Encryption

All data encrypted in transit using modern industry-standard protocols.

Access Controls

Role-based access controls and least-privilege enforcement across all systems.

Continuous Monitoring

Real-time threat detection with proactive security event monitoring.

Network Protection

Firewalls, intrusion prevention, and web application security measures.

Compliance Ready

Controls aligned with industry standards and comprehensive audit logging.

Ready to Transform Your AML Compliance?

Join the financial institutions that have streamlined their risk assessment processes and gained peace of mind with iTrackAML's comprehensive solution.

No commitments. Our team will guide you through the platform and answer all your questions.